Winneshiek County Development (WCDI) and Decorah Jobs have received feedback from community members seeking more information regarding the recent news articles regarding the potential development which would involve a new grocery retailer in Decorah. Due to this request, an outline of some of the highlights and details of this opportunity have been put together to address these frequently asked questions. In addition to asking questions, many community members have asked how the community can help support this opportunity, as many expressed regret after not having been involved in previous missed development opportunities. WCDI and Decorah Jobs would like to encourage all members of our region that support this opportunity, to contact our organizations, their local city council representative, the Decorah mayor, and/or submit a letter to the editor to local media expressing support for the project.

A central question has revolved around incentives being made available to the developer seeking to secure this new project. As economic development opportunities arise, it is not unusual that a community participates by providing matching funds of approximately 20-25% in the form of Tax Increment Financing, Tax Rebates, Tax Abatement, and/or forgivable loans. In this specific project, a mixture of a forgivable loan and a tax rebate has been discussed by the development group. With the security of such a package, the develop will in turn invest approximately $3 million dollars to modernize the facility and attract the high-quality tenant. The incentive package which Decorah Jobs has negotiated, equates to 24% of the total project investment, which, according to the Iowa Economic Development Authority, is within range of the 20-25% typically provided by other communities as they work to attract an anchor tenant that creates this type of investment and benefit to their community.

These types of projects, and the negotiations that help to secure them, often have many moving parts and are quite complex. Many people are not fully aware of how tax abatements/tax rebates work. In this scenario, the investment being made by the developer will double the taxable value of the current structure previously occupied by Quillins. With the proposed package, the developer will pay 100% of the current taxable value, as well as the newly assessed property taxes after the building has been renovated. Upon payment, the City of Decorah will provide rebate of the taxes associated with, and as a result of, the improvements only. This plan will act as though the old Quillin’s structure never received a renovation, and the current real estate tax revenue received for the facility will remain constant, thus causing no disruption of current tax revenues to the city, county, school district, or other taxing authorities. It is important to note that these types of packages have been utilized to spur development in our community in the past and can be requested by other projects as well.

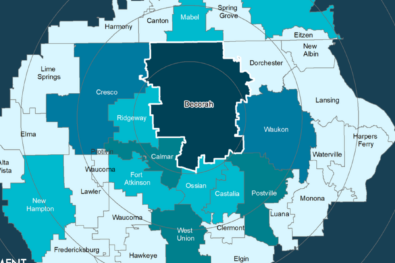

A development opportunity like this not only affects the city in which it resides, but also the entire region. In securing an anchor tenant, we will be securing the opportunity to bring in additional future real estate tax revenue and immediate sales tax dollars to be split between county, city, schools, hospital, and other recipients from the tax levies. Our region will also have access to additional choices in retailers, further employment opportunities for up to 70 of our citizens, and the increased payroll activity that keeps local monies circulating in our area and supporting other business. The addition of a project like this will continue to build on the “draw factor” that our great county experiences, and will bring out-of-county money to our area to further push local sales tax opportunities higher.

Overall, we are encouraged to hear the broad support of this project and the excitement it is generating. While the prospect of a great new retailer is extraordinary, what we really hope the people of our area are excited about is the opportunity we have to make an investment in our future. We are blessed to have the economic prosperity that can only be envied by many of our peer counties and this is not something to be taken for granted.